Red Chalk Studios presents our series on buyer, or customer, psychology — what it is, why it matters, and how understanding it can make a powerful difference in your business every day. If you haven’t read them yet, back up and start with:

- It’s Time to Talk About Your Elephant, Part 1

- Retain Customers By Appealing to the Elephant, Part 2

- Oh, How Elephants Hate Losing Things, Part 3

It’s fair to assume that as a business professional, you have a clear understanding that the point of marketing is to ultimately create a relationship with your customers that includes the exchange of products or services for money.

But what money means to one person may be completely different to the next person.

What is money?

On one hand, the invention of money allowed us to exchange goods and services quickly and efficiently without the hassle of carrying 40 chickens around to trade. On the other hand, money removed us from that more physical exchange, and skewed the idea of what things are worth.

Unfortunately, humans did not come pre-programmed with set values for specific life-improving items. There is no unit of measurement for pleasure.

Which is why it’s difficult to determine what people are willing to pay for things.

But perhaps even more important is: What motivates someone to make a purchase?

The Difference Between Losing Money and Spending It

Well, luckily for us, we can find some insights in the study of customer psychology if we dig a little deeper. To get to the bottom of what money is to us, we have to look at how money makes us feel when we lose it and how we feel when we spend it.

There is a huge difference between losing money and spending money, though they are functionally the same.

It comes down to the intensity of feeling. Studies show that people feel the pain of a loss much more strongly than they feel the pleasure of a gain.

For example, studies show that most people prefer winning $50 with certainty rather than taking a risky bet in which they could toss a coin and either win $100 or nothing.

But the driving force (shall we call it, perhaps, the elephant?) in that choice isn’t the guaranteed pleasure of winning $50, it’s avoiding the potential loss of $100.

The pain of loss is a stronger motivator than the reward of gain.

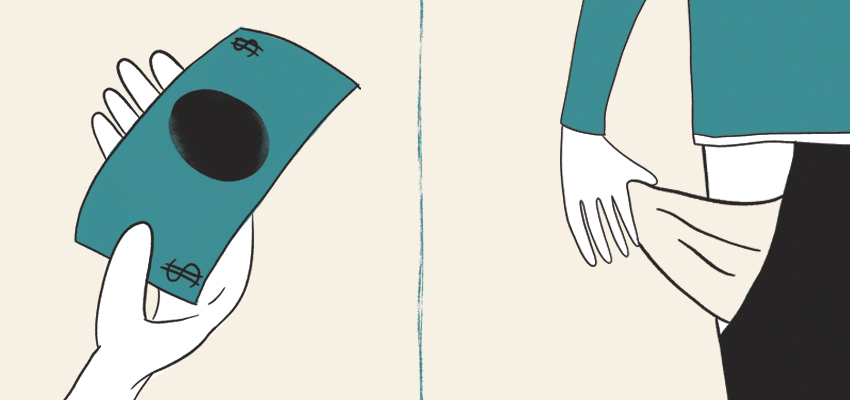

For marketers, this knowledge is powerful. Say you typically incentivize your customers to save. Nothing wrong with that, right? You send this message: “Enroll in automatic billing and save 5% each year!”

But what if, instead, you shift your message to use the power of “loss avoidance,” and speak straight to the elephant?

What do you think happens when you send this alternative message: “We care about helping you save. Did you know that not enrolling in automatic billing could cost you over $100 a year? We can help you change that.”

What’s the difference?

In either case, you’re offering your customer the opportunity to save the same amount of money a year. So why does the idea of losing over $100 a year make people sign up in droves for automatic billing while the idea of saving 5% a year gets just a lukewarm response?

It hurts more to lose than it feels good to gain.

More examples…

Instead of: “This weekend, when you buy one pair of shoes, we’ll give you another pair free!”

Do this: “Miss this BOGO sale, and you’ll lose out on not one, but two pairs of shoes!”

Instead of: “Buy a $50 ticket before Saturday and you can save 20% with the early-bird discount!”

Do this: “Wait until after Saturday to buy a $50 ticket and you’ll lose $10 in savings. Get your ticket today!”

Talk to the elephant.

When you understand the elephant inside your customer’s mind, you can develop strategies that can lead to better sales, better service and better customer retention.